There are a number of reasons that a bank DISHONORS a check.

1) DAIF: Drawn Against Insufficient Funds;

2) DAUD: Drawn Against Uncollected Deposit;

3) CLOSED ACCOUNT;

4) Stop Payment Order; and

5) Other issues in the check like wrong spelling, illegible handwriting or lack of signature.

Bouncing checks are checks na binalik ng banko sa iyo dahil hindi enough yung pera mo sa checking account mo. Ito yung DAIF or DAUD or CLOSED ACCOUNT. Ang term natin is “Pagputok ng Cheke”,

You can write ANYTHING on the check. Sky is the limit! Provided of course na ang laman ng bank account mo kasya ang amount na sinulat mo. One-day clearing na ngayon. Dati 3 days. Kung wala pala laman ang bank account mo, your check will bounce and walang papasok na pera sa bank account ng pinagbayaran mo. So hindi ka pa bayad. Pinaasa mo lang siya.

Mag-ingat sa pag-issue ng check na walang pondo. May bank charges yan. If you bounce a check, the bank deducts a minimum of P2,400 from your bank account kung may laman pa. Ang mahal diba? If tatlong beses ka na nagpabounce ng check, the bank closes your bank account. So hindi mo na magagamit ito forever. You will have to open a new one which is less likely to happen kasi the bank will not allow it na kasi bounce ka ng bounce ng cheke mo. Iba-iba ang rules ng mga banks. So whatever bank yung checking account mo, alamin mo ang fees and rules nila sa bouncing checks. Or wag ka na lang magpabounce ng check para hindi mo kailangan alamin pa yan.

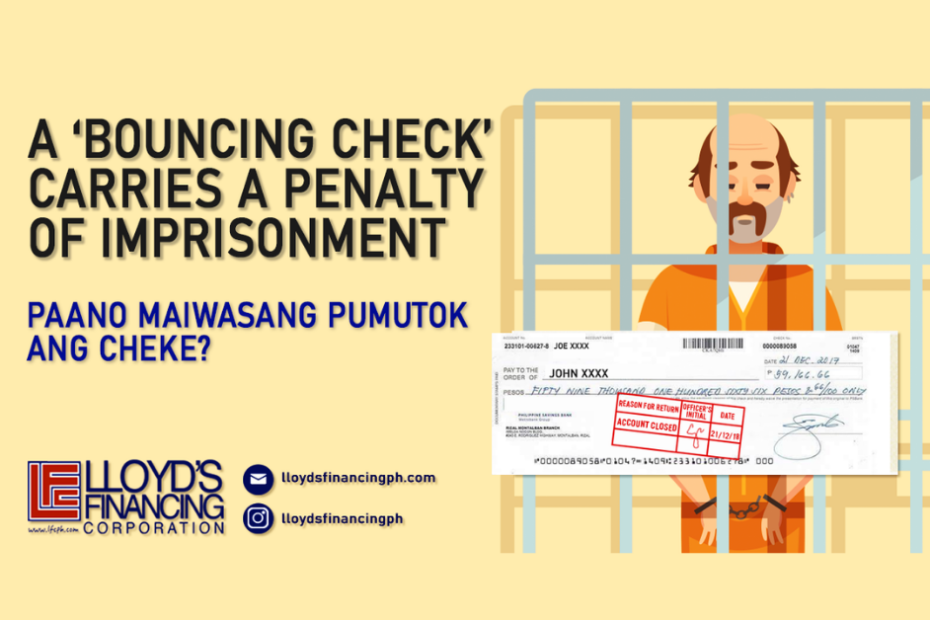

Bouncing a Check is a CRIME. BP22, known as The Bouncing Checks Law punishes a person for issuing a worthless check. It carries a penalty of IMPRISONMENT of 30 days to 1 year or a FINE of a minimum of double the amount written on the check up to P200K for BP22 cases. Ok lang yan. Kung in good faith ka naman, or hindi mo alam na wala ka pala pondo, this will be dismissed in your favor. Unless the bank gave you a clear Notice of Dishonor at Seen Zone mo lang siya, then sorry ka. Kasalanan mo.

Kapag ESTAFA naman ang kaso, the penalty is IMPRISONMENT of 2 months to 8 years depending on the gravity of the Fraud. If you issued a check knowing na Closed Account ka na, ito ay isang FRAUD kasi ibig sabihin ay sinadya mo talaga. Kaya mas matindi ang penalty ng Estafa.

So HOW TO AVOID BOUNCING A CHECK? Lalo na sa mga First Timers jan, alamin!

1) Know your Balance: Alamin kung magkano talaga ang laman ng bank account mo muna bago ka mag-issue ng cheke.

2) Keep a Back-Up Fund: Ang checking account ay mas malaki ang maintaining balance. This is for your protection from mistakes.

3) Monitor your Account: Make sure you monitor all checks issued, withdrawals and deposits. Dapat mas updated ka sa account mo kesa sa banko.

4) Talk to your Payees: When you realize na nagkamali ka at sure ka na puputok ang cheke na pinambayad mo sa kanila, inform them Immediately at makiusap na wag muna ideposit ang cheke. Ask them to give you time to fund your account before nila deposit.

If meron kang valid checking account at hindi mag ba bounce and checke mo, pasok ka sa 0.88% interest loan promo ng Lloyd’s na Extended until January 31, 2021. Message Us Now!