Since 1988, Lloyd’s has helped hundreds of businesses.

Hindi kami tulad ng iba na utang, bayad, utang, bayad lang… walang direction… Sa Lloyd’s, habang hindi ka yumayaman, hindi ka iiwan.

Makipag-PARTNER sa Lloyd’s! Ikaw sa Negosyo, ang Lloyd’s naman sa Pondo! Ikaw ang laging lamang, hindi nilalamangan. Ikaw and laging nakikinabang, hindi pinakikinabangan. Ikaw and laging kumikita, hindi pinagkakakitaan.

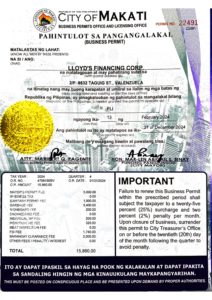

Visit us to see that we are LEGIT! #9532B Simkimban Bldg. Taguig St. Makati City.

A Revolving Credit Line is the amount that remains available even as you pay the balance. Borrowers can access credit up to a certain amount (credit limit) and then have ongoing access to that amount of credit. They can repay the balance in full, or make regular payments. Each payment, minus the interest and fees charged, opens the credit again to the account holder.

How Does it Work?

When a borrower is approved for a revolving credit line, the financial institution establishes a Credit Limit that can be used over and over again, all or in part. A Credit Limit is the maximum amount of money a financial institution is willing to extend to a customer seeking funds.

For example, LFC approves a borrower a Credit Line of 100k with a Credit Limit of 80% for NEW Borrowers. The borrow has access to revolving fund of 80k out of 100k. If the borrower remains in good standing, LFC increases the borrower’s credit limit to 100% thereby opening the credit limit to 20k more, a total of 100k. If the borrower remains in good standing for over a year, LFC may increase the credit limit 10% to 25% beyond the credit line itself. At LFC, the credit limit may extend beyond the credit line, a service unique only at LFC.

At LFC, the credit line is secured by the borrower’s cash deposit as collateral instead of tangible properties such as car or real estate. The advantages of cash collateral over property collateral are:

- No need to valuate the market value of a property

- No need to pay for encumbrance fees, mortgage fees and high property taxes

- No need for excessive requirements

- No need to wait for over a month to have your loan proceeds release. We release the loan proceeds within 24-48 hours.

- No foreclosure or repossession

- Upon full payment, no need to wait for the release of the property or the payment of cancellation of mortgage. Just request to withdraw your cash deposit and it will be released within 24-48 hours.

Revolving Credit vs. Installment Loan

- As long as your cash collateral remains intact, there is no need for the company to conduct another credit investigation for the borrower to be approved another loan.

- As the cash collateral increases, so does the credit line and credit limit. No need for the re-assessment of the borrower’s capacity to pay.

- As the balance is paid, the credit is open and the borrower can access to the amounts paid as many times as the need arises. Whereas with the installment loan, the borrower cannot access the amounts paid as long as the loan balance remains unpaid.

- The borrower can only have one loan contract with the installment loan. While with the revolving credit line, the borrower can have as many loans as necessary with various terms (short-term or long-term).

- With a revolving credit line, it is a TRADE & GO. ANYWHERE, ANYTIME.

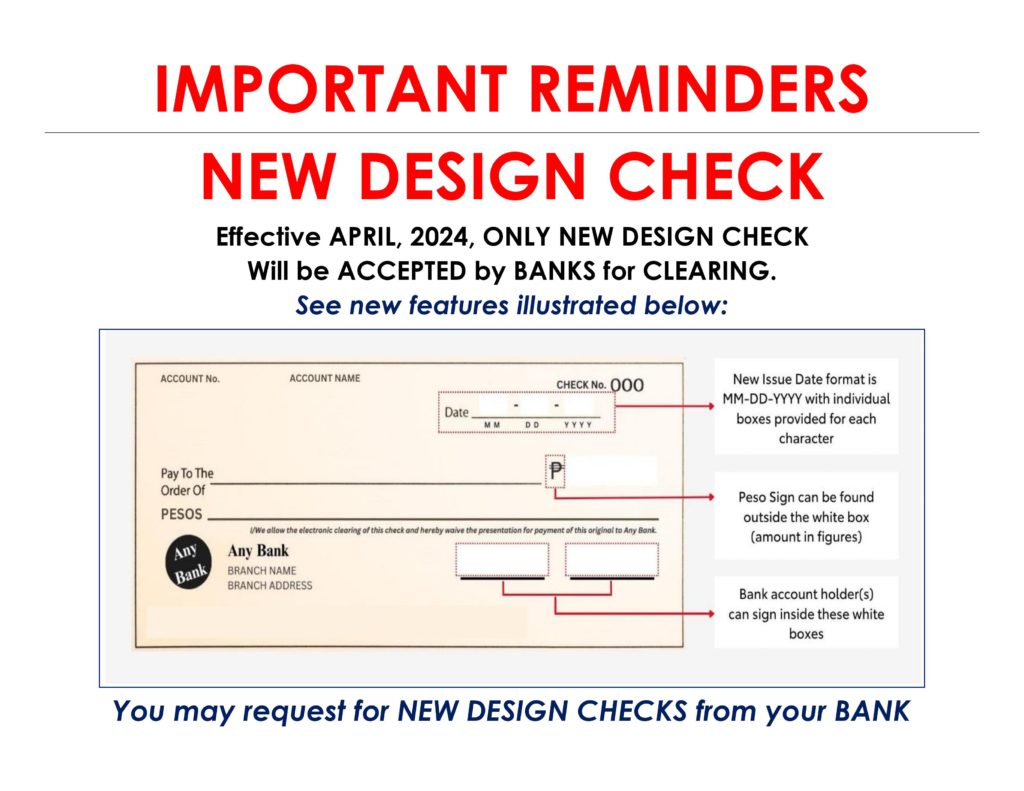

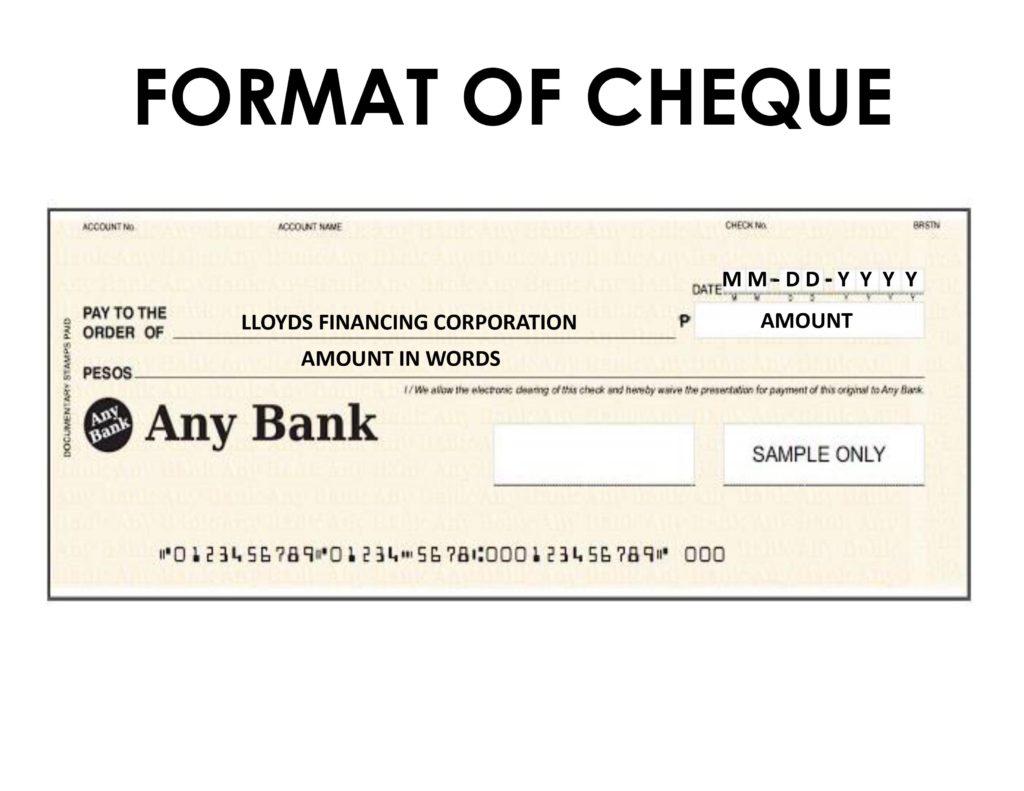

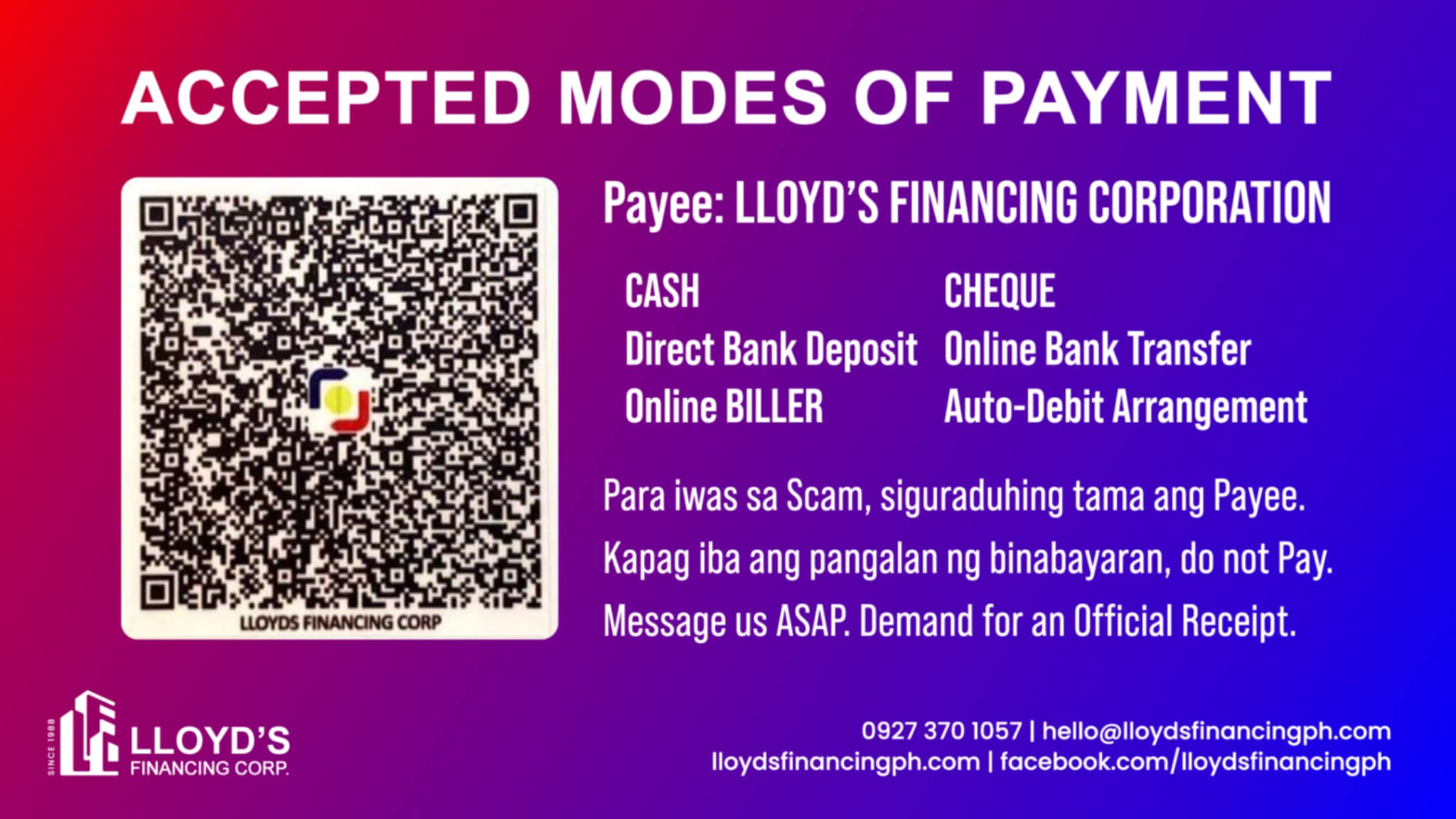

Our mode of payment is via Post-Dated Checks (PDCs).

Not necessarily. Having a checking account will make your loan application processing much faster.

Please read testimonials of our clients. They are also posted on our official Facebook Page.

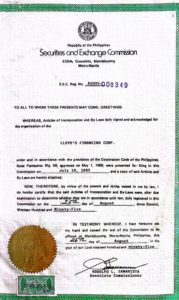

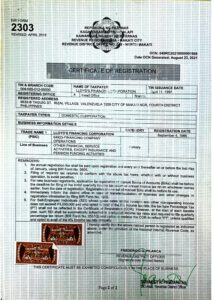

We are a corporation registered in Securities and Exchange Commission (SEC)..

PDIC insures only up to P500,000 of your cash deposit. Whereas, LFC insures 100% of the borrower’s cash collateral.

We are Strictly Face-to-Face transactions only in order to avoid scams. We would like the opportunity to disclose our product properly to you and answer all your questions and address all your concerns in person. We also give out free Starbucks gift certificates for those who drop by our head office in Makati.

24-48 hours from compliance of requirements. Don’t worry. We do not decline applicants with Savings and Checking Accounts.

Yes. We have a special program for that. You may drop by our head office so we can discuss your options.

None as of the moment. These products are currently being deliberated upon and might be released by the year late 2025.

Initially,

- At least two (2) valid primary IDs

- CHECKING ACCOUNT

- Savings Account

- Business permit

- Passbook of your checking account